NAPERVILLE, IL (07.23.2021) – IMR Inc., the industry’s leading full-service automotive market research firm, has released its latest insights on how battery and hybrid electric vehicle service is impacting independent repair shops.

Between May 3 and June 30, 2021, IMR Inc. interviewed 1,000 independent repair shops in the U.S. to gain insight on their service of battery and hybrid electric vehicles and investment in specific tools, equipment and training for technicians to work on these newer vehicle technologies.

Click here to view the report

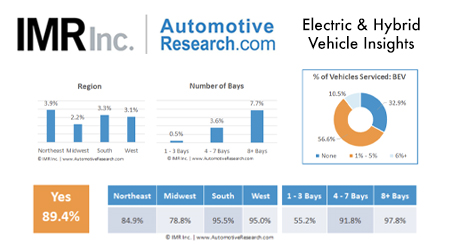

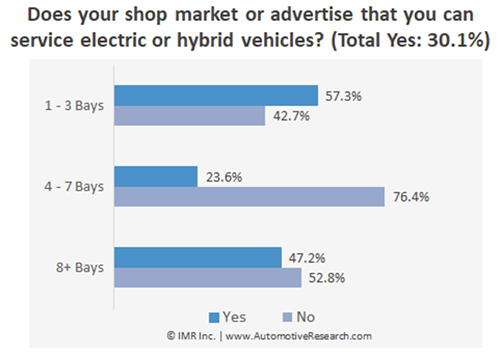

Three out of every 100 vehicles (3.1%) serviced at an average independent repair shop are BEVs while HEVs account for 6.2% of the vehicles serviced. Shops located in the West (7.7%) have nearly double the percentage of business from HEVs over shops located in the Midwest (4.2%). Of shops that service BEVs/HEVs, 69.9% do not specifically market or advertise that t

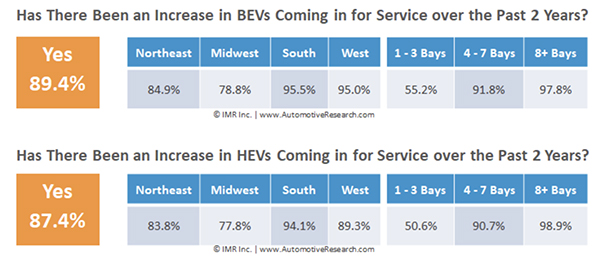

- Of independent repair shops that service hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs), over 85% have seen an increase in service demand for these vehicle types

- 27.5% of shops that service BEVs/HEVs have invested in specialized tools/equipment, 30.5% have invested in additional technician training

- 55.1% of shops believe it will take longer than 10 years for BEVs/HEVs to impact their business

Of independent repair shops that service BEVs and HEVs, 89.4% have seen an increase in the number of BEVs coming in for service while 87.4% have seen an increase in HEVs coming in for service. However, amongst all independent repair shops, only 27.5% of shops have invested in tools and equipment to specifically service BEVs/HEVs while 30.5% of shops said they had invested in additional/specialized training for technicians, focused on electric or hybrid vehicles. Overall, larger shops (8+ bays) made more investments in tools, equipment and training (48.9%) than their smaller competitors (26.4%).

With the increasing market penetration of BEVs/HEVs and rapidly evolving technologies, independent repair shops who service these vehicles recognize the importance of keeping up with current information. 46.7% of shops reported that their primary supplier provides updates on the latest industry trends regarding BEVs/HEVs, while 53.3% of shops said theirs does not.

While 67% of independent repair shops indicate that a portion of their business comes from servicing BEVs, more than 55% of shops surveyed believe it will take over 10 years for BEVs/HEVs to impact their business. 13.4% of shops believe that these vehicle types will never impact their business.

For more information on IMR Inc., visit automotiveresearch.com. To schedule a research-related interview with IMR Inc. president, contact the company. The most recent Insights from IMR Inc. can be found here.